Table of Contents

1. Now, Where, How

2. The Gap Between Now and Where

3. The Five Pillars of Value

4. Beware the Curse of Assumption

5. Showing Your Clients What's Possible

6. A Value Gap Analysis Report as Step One

7. Making the Value Gap Analysis Report a 'Business as Usual' Service

8. Accounting 101 for Your Accounting Team

9. Monetising this Service

10. Next Steps

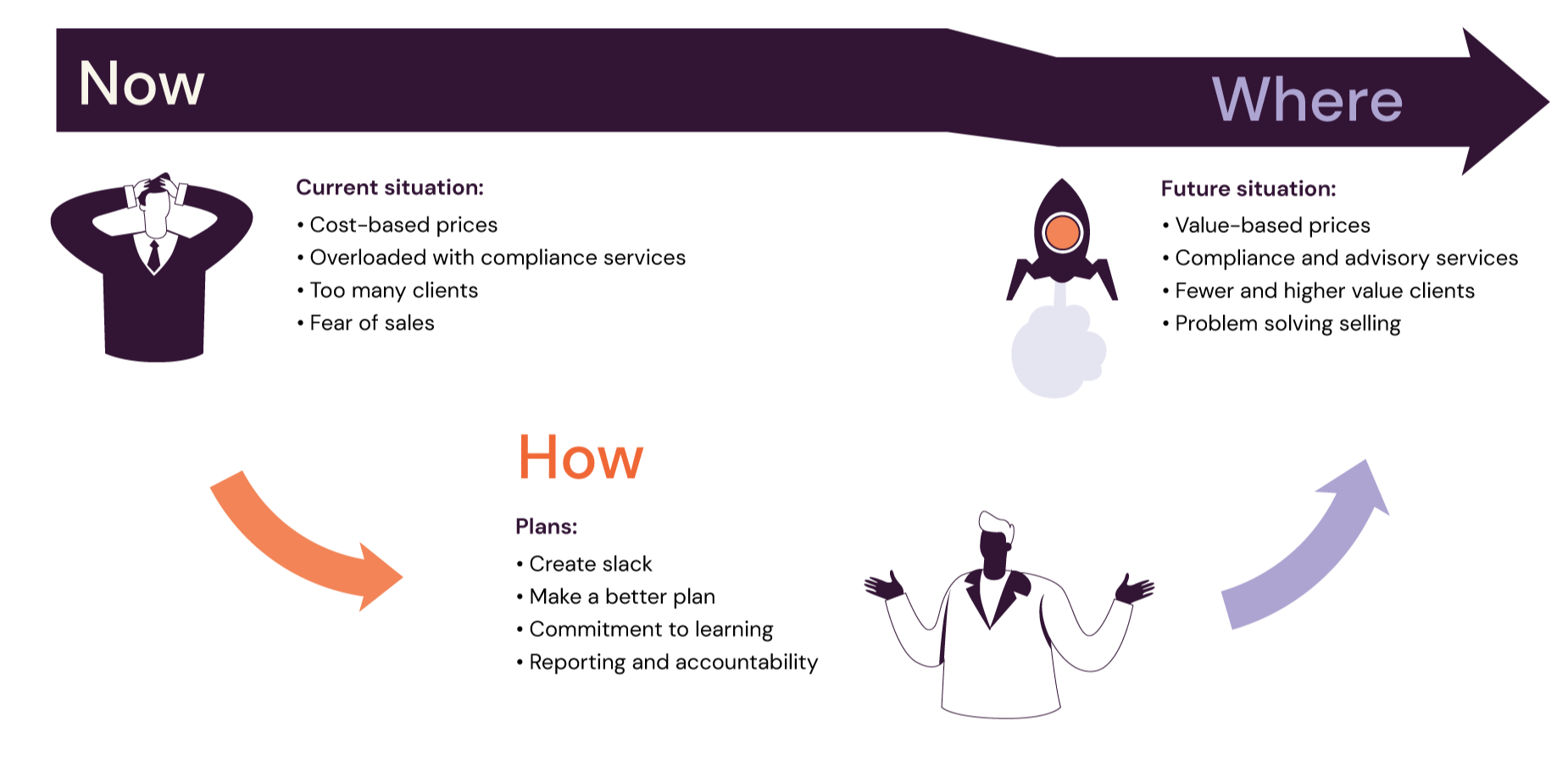

Now, Where, How.

For many SMEs there’s a gap between where they are now and where they want to be in the future.

Their 'Now' lacks one or more of the three freedoms:

- Time freedom. They’re not getting the time away from the business they need and this impacts their relationships with family and friends.

- Financial freedom. They’re not drawing the money from the business that they need to support the lifestyle they imagined.

- Mind freedom. They’re often stressed and consumed by what the business demands of them.

Xero’s recent ‘Money Matters’ report, an online survey of more than 500 SME businesses, pointed out the human cost for many owners. Key takeouts of that report include:

.png)

.png)

.png)

The Gap Between Now and Where

The ‘How’ is the piece that so many of your clients struggle with. They’re busy in the business and don’t dedicate time to working on their business.

Many accounting firms have purpose statements and marketing messages that make it clear they want to help their clients build a more successful business. It’s common to read taglines such as "We are your trusted business partner".

If firms believe their own rhetoric, then it’s their duty of care to help clients understand what’s possible; the small changes that can be implemented to close that gap. In doing so, they are simply linking their purpose to the support their clients need.

The ‘How’, that space in the middle of ‘Now’ and ‘Where’, comes in the form of the services that you offer to close that gap.

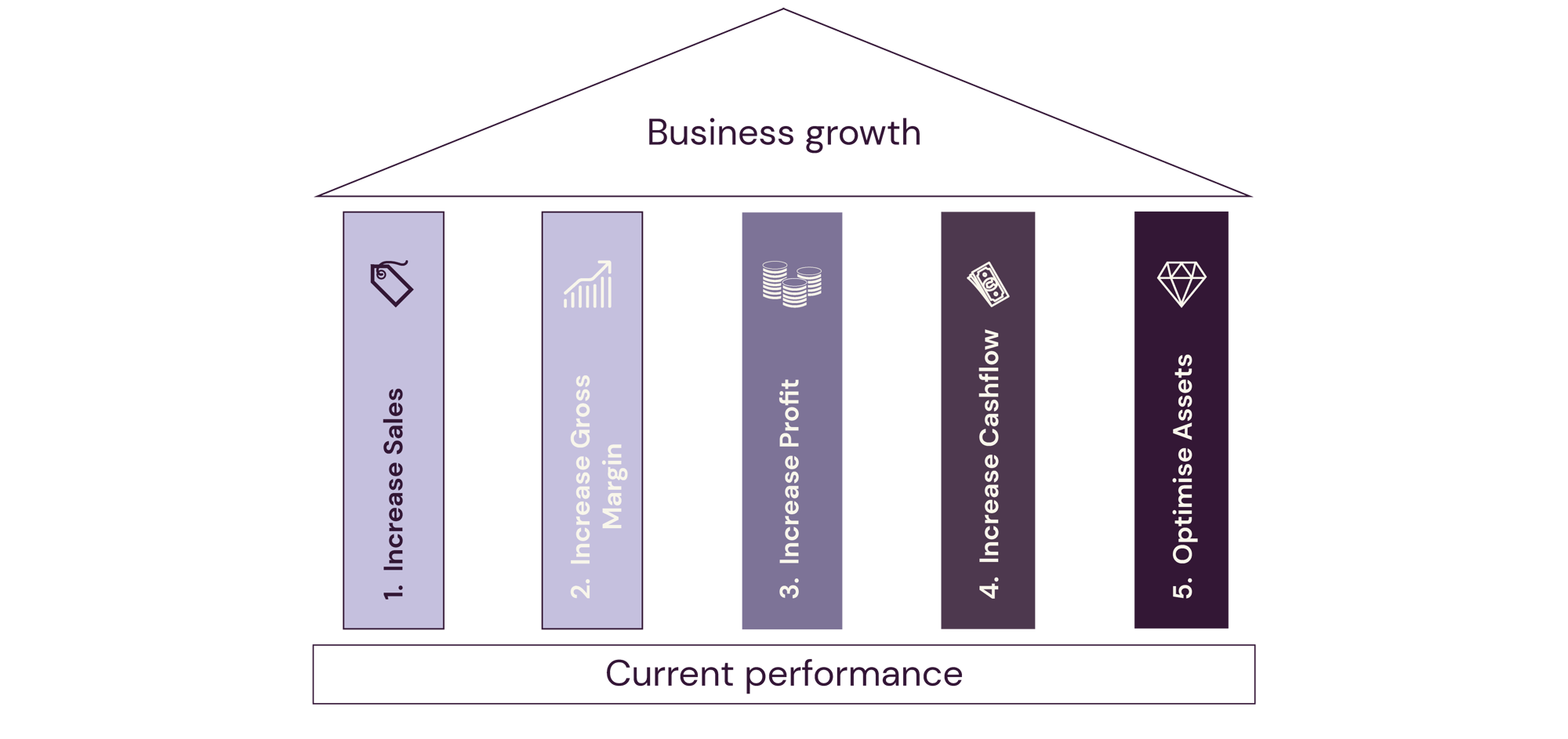

The Five Pillars of Value

It makes sense to focus initially on the financial performance of the business, using The Five Pillars of Value.

Focusing on improving the financial performance of the business will often improve mind freedom, particularly if we ensure the business enjoys better cashflow.

Improving profit and cashflow can also open up opportunities for owners to gain better time freedom. Better financial results enable the owners to invest in robust planning, people, and process improvement.

1. Increasing sales

There are five ways to increase sales. It’s vital that your accounting team know these by heart.

- Increase customer retention rates.

- Gain more leads.

- Increase the lead to customer conversion rate.

- Increase average customer spend.

- Increase customer transaction frequency.

It’s likely that many clients won’t know much about the composition of their customer base, or even how many customers they have. It’s even more likely that they will have little appreciation for the impact that improving one of the above revenue strategies will have on the profit and cashflow of the business. The key is to show them what’s possible.

2. Increasing gross profit margin

Simply moving gross profit margin by as little as 2% can have a big impact on profit and therefore cashflow. Never assume that your clients fully understand the impacts of small changes like these. As accountants, we do the maths in a split second. Our clients don’t.

3. Reducing Overheads

Reducing overheads is harder to do than first imagined, especially in inflationary times. Still, a review of each expense line is necessary and best practice on at least an annual basis. Fixed costs are just that - fixed. Discretionary overheads need to contribute to the performance and sustainability of the business.

Don’t be afraid to raise the topic of accounting fees. If your clients are getting value from their spend with you, and if you're focused on helping them improve profitability, cashflow, and ultimately, the value of their business, they should see their spend with you as an investment. If not, you’re just another overhead, and one that should be minimised.

4. Increasing Cashflow

How many times have you heard your clients make comments like "I made so much profit, but it's not reflected in my bank account", or "The business seems to be making money, but I'm struggling to pay suppliers on time."?

One of the keys to their financial awareness is understanding how long it takes them to convert the sale of goods or services into cash.

The Cash Conversion Cycle

Understanding their Cash Conversion Cycle helps clients understand why growing a business can put pressure on cashflow, and the reasons for the mismatch between the profit they are generating and free cashflow.

The big shift in thinking, however, comes when they understand how a small change in debtor days or work in progress days, for example, impacts cashflow.

.png)

5. Optimising Assets

Increasing revenue per FTE, increasing average hourly rates, and retiring non-performing business assets are all ways to get a better return on business assets.

Beware the Curse of Assumption

Many of our beliefs and assumptions develop over time and lead to unconscious bias.

For example, let’s imagine you've had a client for several years. They seem happy with the performance of their business and have never asked you for specific improvement advice. You meet each year to go over the financials and tax returns and they appear self-sufficient. At some point in time, you develop the assumption that they don’t need additional support from you. And so, you don’t ask them about their business and lifestyle goals, or biggest challenges, and you don’t offer to explore strategies to improve profitability, cashflow, and business value.

One way to avoid the curse of assumption is simply to ask open ended questions, such as:

- Where do you believe your business could perform better? Why did you choose these areas? What would improvement in these areas look like to you?

- How do you feel about the amount of cash you were able to withdraw from the business to fund your preferred lifestyle?

- Which area would you like to focus on most in your business?

The answers to questions like these may surprise you. This is just one reason why we believe in client pre-work for meetings. Pre-work avoids a meeting of discovery and means that meeting time is spent discussing potential solutions. Ask the right questions and your clients will tell you what they need from you.

Showing Your Clients What’s Possible

You’re in a client meeting. Your client wants help to improve profitability and cashflow. You discuss with them the impact that a margin lift of 2% will have on the bottom line. Time passes, the meeting ends, and your client leaves with no plan, let alone a next step. Sound familiar?

A more valuable way to close the meeting would be to provide your client with a simple report that shows the impact of the 2-3 strategies you discussed, with conceptual agreement for the next step, for example, a Cashflow & Profit Improvement Meeting.

There’s an important distinction to be made here. The first step in helping clients improve their business performance is simply to show them what’s possible. Trying to solve deeply entrenched business problems in 15 minutes by blurting out ill-considered answers is not going to add much value to them or you.

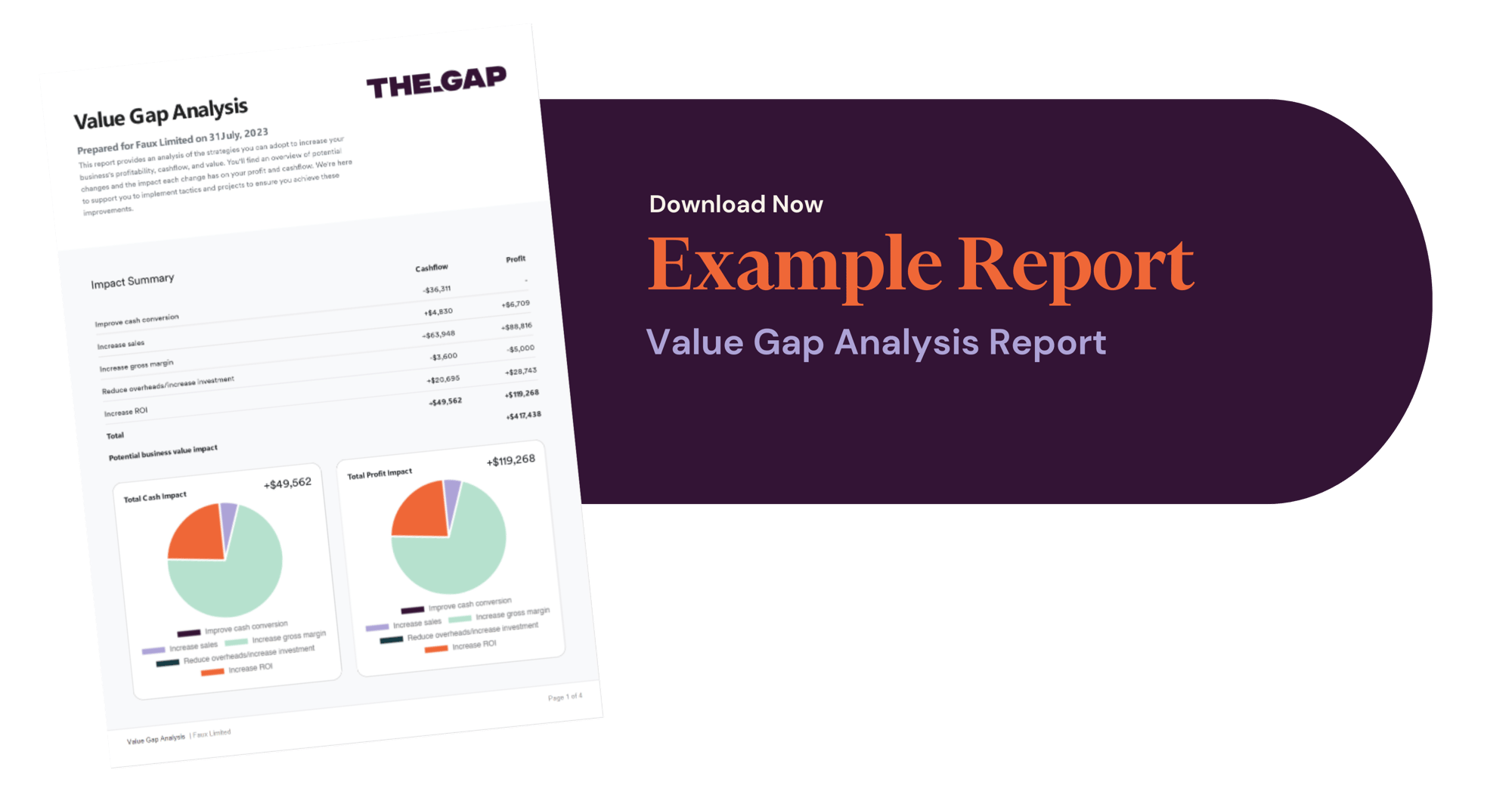

A Value Gap Analysis Report as Step One

Some accounting firms have acquired or created a profit and cashflow improvement calculator, perhaps using Excel. That’s one approach.

We’ve created our own Value Gap Calculator. Just enter some numbers from your clients’ financials, then make small changes to 2-3 strategies, with your client’s input.

For example, you might focus on three strategies: increase sales by 5%, margin by 3%, and reduce debtor days by 6. Talk your client through the impact of these changes on cashflow, profit, and potential business value.

Now, provide your client with a report that shows the cashflow, profit, and valuation impact of these changes and suggest the next step, which might be to book a meeting to agree and document the tactics to support each strategy.

Here’s an example of our Value Gap Analysis Report.

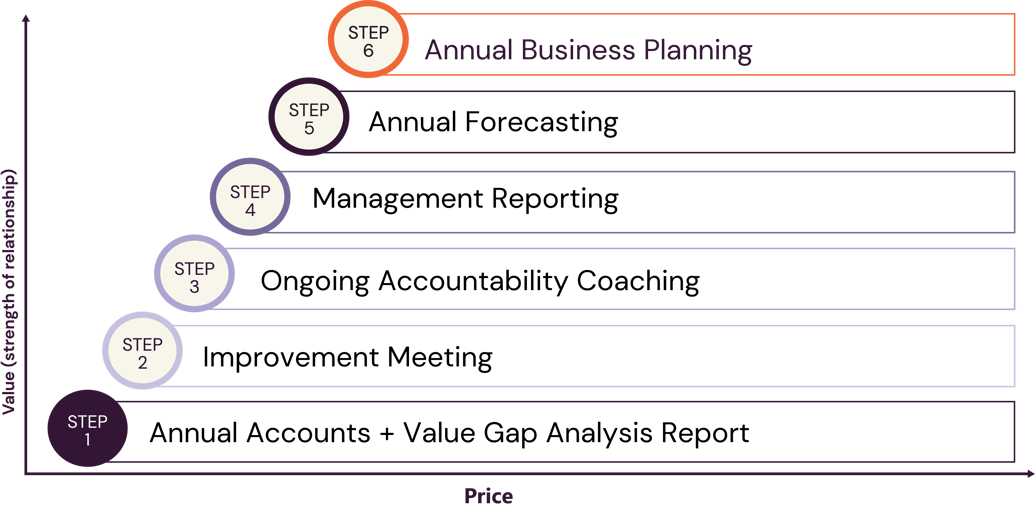

Making the Value Gap Analysis Report a ‘Business as Usual’ Service

Conversations about how you can help clients improve profitability and cashflow should be normal between you and your clients. To start the conversation, roll a Value Gap Analysis Report into the following meetings and services:

- Onboarding meetings

- Annual Accounts Review Meetings

- Management Reporting

- Forecasting

- Coaching meetings

Many Gap firms add a Value Gap Analysis Report to the Annual Financial Statements. The Annual Accounts Review Meeting becomes a game of two halves. The financials and tax position are the rear-facing part; the Value Gap Analysis Report is forward-facing.

.png)

Accounting 101 for Your Accounting Team

All of your accountants should be able to enter data into the Value Gap Calculator, make some simple changes to profit and cashflow levers, and talk clients through what’s possible. If this isn’t currently Accounting 101, then it should be. These types of conversations are part of the commercial journey your accountants need to take to develop their soft skills and speak wider than the numbers.

Monetising this Service

You absolutely can (and should) monetise this type of report. Some of our Gap members charge as little as $250 +GST (NZD) annually, with others charging up to $750 +GST. Entering client data and running the report takes less than 10 minutes. Not bad for a value-add report that also helps to market and sell your advisory services.

For you

Interested in closing the value gap for your clients? Take the next step.

- Listen to Co-Founder and Director of The Gap, Mark Jenkins, as he explains the Value Gap analysis Report.

- Take a 30-day free trial of The Gap. You can practise using the Value Gap Calculator and build multiple scenarios for a client.

- Complete your own Gap ROI Calculator and see first-hand how easily you can get a healthy ROI from your investment in The Gap.